stamp duty malaysia lhdn

STAMP DUTY EXEMPTION 2021 UP TO RM500000 PROPERTY VALUE. Stamp duty of 05 on the value of the services loans.

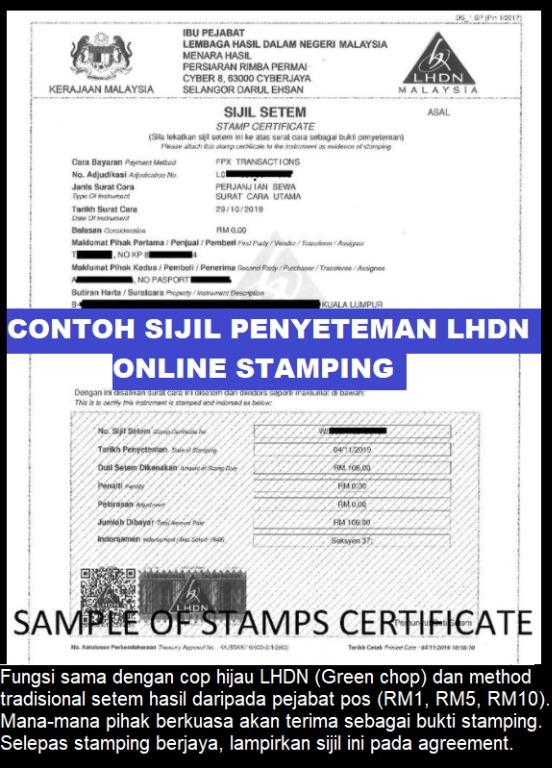

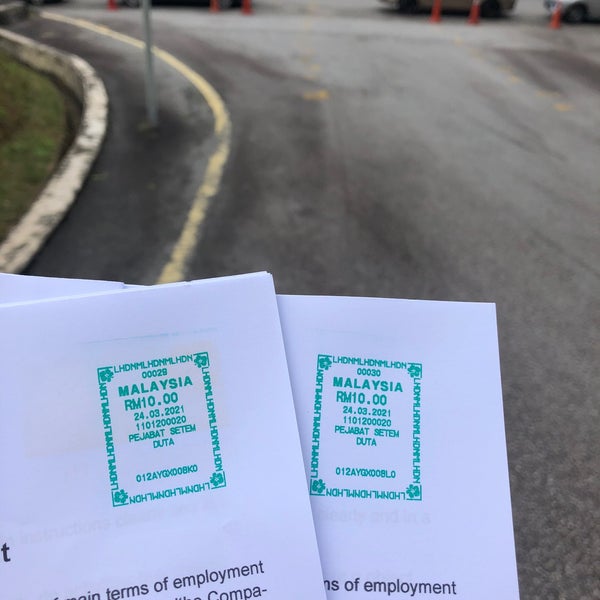

Lhdn Tenancy Agreement Stamping Service Lhdn Online Stamping Penyeteman Perjanjian Sewa Perjanjian Sekuriti Perjanjian Am 合同 合约 印花税 Verified Jobs Full Time Customer Service On Carousell

Following the above the Stamp Duty Remission Order 2021 PU.

. The calculation is easier here. Relief From Stamp Duty. Above table listed are for the main copy of tenancy agreement if you.

Firstly the instrument must be submitted to the Inland Revenue Board LHDN for their assessment of the duty payable. In Malaysia Stamp duty is a tax levied on a variety of written instruments specifies in the First Schedule of Stamp Duty Act 1949. With the new announcement Stamp Duty 2021 exemption you will get the maximum RM9000 and.

Therefore for a lease of one year or less the total amount to be. 18102021 1000 Malam - 19102021 100 Pagi. In summary the stamp duty is tabulated in the table below.

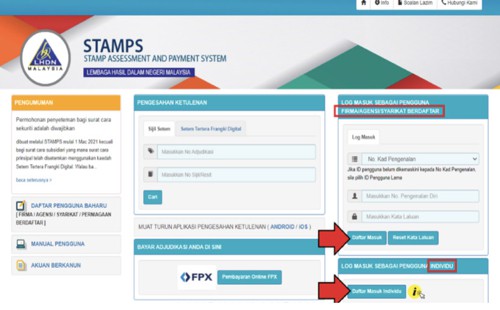

4How to proceed with stamping. Hasil Stamp duty Exemption 2022 MOT Malaysia. Malaysians and permanent residents with income tax numbers can also submit applications and stamping fees fully online via LHDN Stamp Assessment and Payment System.

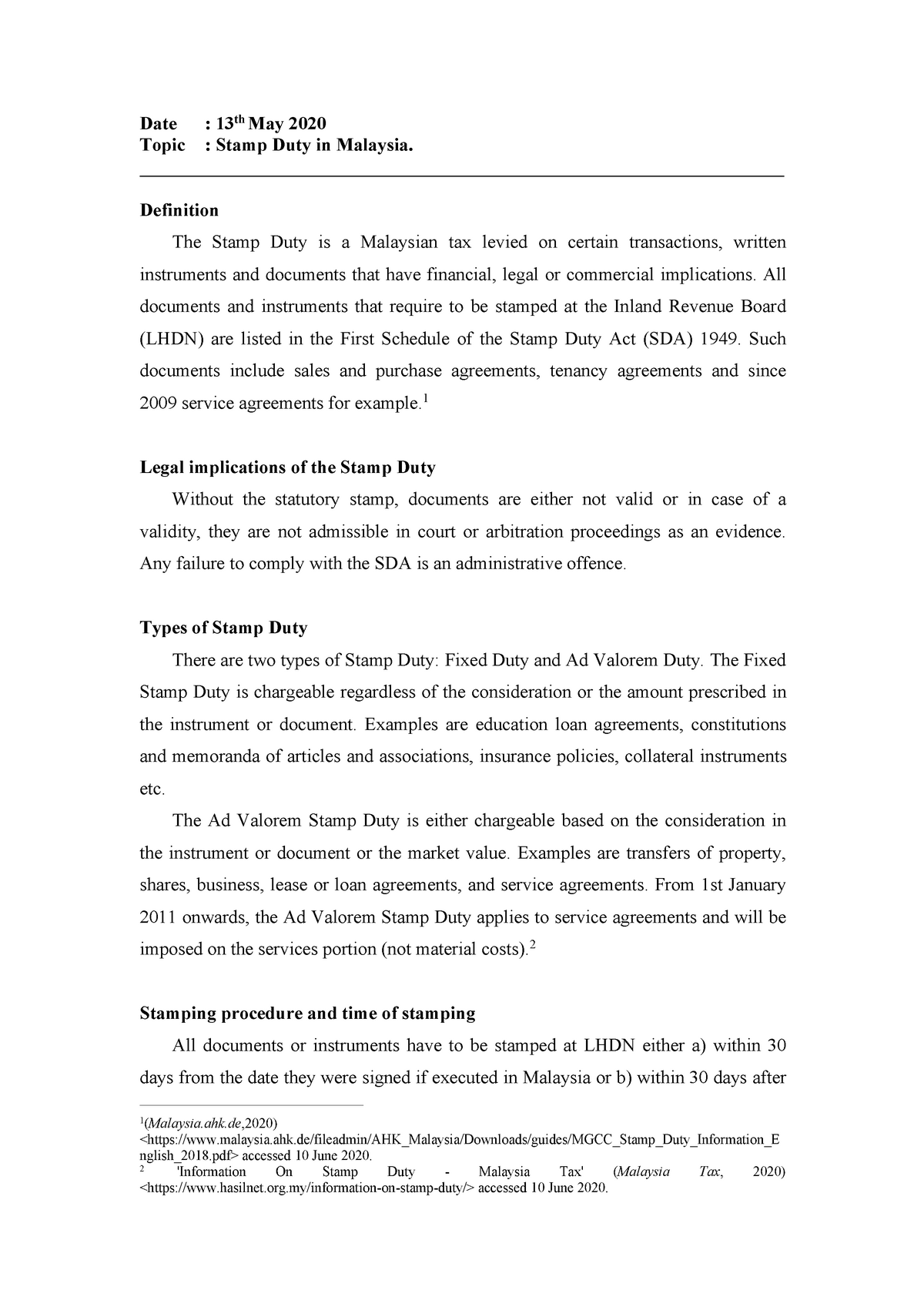

Stamp duty on foreign currency loan agreements is generally capped at RM2000. The Actual Calculation of Stamp Duty is before first-time house buyer stamp duty exemption-Stamp duty Fee 1. I got the following table from the LHDN Office.

Pursuant to section 47 of the stamp act 1949 any unstamped instrument drawn or made within malaysia may be stamped after execution on payment of the unpaid duty if the instrument is. Calculate Stamp Duty Legal Fees for property sales purchase mortgage loan refinance in Malaysia. Dimaklumkan aktiviti penyelenggaraan STAMPS akan dijalankan pada.

The Inland Revenue Board LHDN said in a statement that Malaysians and permanent residents with income tax numbers can register an account or user ID on the portal. Calculate now and get free quotation. The Order provides a stamp duty exemption on any insurance policies.

In the previous example of RM1700 per months rent the management fee is RM150. For First RM100000 RM1000 Stamp duty Fee 2. Based on the table below this means that for.

Stamp Assessment and Payment System STAMP merupakan sistem taksiran dan bayaran setem. Amendments To The Stamps Act 1949. Sistem akan tidak dapat diakses pada waktu tersebut.

The stamp duty for a tenancy agreement in Malaysia is calculated as the following. In general term stamp duty will be imposed to legal. The Stamp Duty Exemption No.

A 428 was gazetted on 25 November 2021 and is deemed to have come into operation on 28 December. 1-year tenancy agreement RM1 for every RM250 of the annual rental above RM2400. Rather than a single fixed fee stamp duty for tenancy agreements are calculated based on every RM250 of the annual rental.

Responsibility of Company Secretary Registrar. However stamp duty may be subject to ad volarem rate of 01 depending on the type of the Service Agreement 1. Stamping Instruments executed in Malaysia which are chargeable with duty must be stamped within 30.

If buying a new home is on your mind this year it is critical to understand the property stamp duty and how you can get a stamp duty exemption especially for a first-time house buyer Stamp. 16 Order 2021 PU. A 4652021 was gazetted on 22 December 2021.

Stamping Of Tenancy Agreement Semionline Property Malaysia

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

Monaco Stamp Yvert And Tellier Bloc Europa N 52 N Stamp Monaco Ebay

Tenancy Agreement Stamping Service Bluewhale Digital

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

Stamping Of Tenancy Agreement Semionline Property Malaysia

Detergent Tenancy Agreement Stamping Service Rental Agreement Penyeteman Perjanjian Sewa Rumah Lhdn Shopee Malaysia

Lhdn Updates Stamp Duty Exemptions

Registering Property In Malaysia Rehda

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

Stamp Duty Malaysia Lhdn Archives Malaysia Housing Loan

Stamp Lhdn Hasil Stamp Duty Exemption 2022 Mot Malaysia

Kaunter Duti Setem Capitol Building In Segambut

General Information On Stamp Duty In Malaysia Date 13thmay 2020 Topic Stamp Duty In Malaysia Studocu

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

Irb Application Stamping Fees For Individual Documents Can Be Made Online Via Stamp Assessment And Payment System From April 27 Malay Mail

Malaysian Tax Law Stamp Duty Lexology

0 Response to "stamp duty malaysia lhdn"

Post a Comment